Advance tax, also known as estimated tax, is a system used by the United States government to collect income tax from individuals and businesses throughout the year, rather than in a lump sum at the end of the year. In this blog post, we’ll break down what advance tax is, who needs to pay it, and how to calculate and pay it.

What is Advance Tax?

Advance tax, or estimated tax, is a system used by the IRS to collect income tax throughout the year. This system is used to ensure that taxpayers are paying their tax liability as they earn income, rather than waiting until the end of the year to pay a large lump sum.

Who Needs to Pay Advance Tax?

If you’re self-employed, receive income from sources that aren’t subject to withholding (such as rental income or investment income), or don’t have enough taxes withheld from your regular paycheck, you may need to make estimated tax payments.

How to Calculate Advance Tax

To calculate your estimated tax payments, you’ll need to estimate your total income for the year, as well as your deductions and credits. You can use Form 1040-ES to help you estimate your tax liability for the year.

Once you have estimated your total tax liability for the year, you can divide that amount by four to determine your quarterly estimated tax payments. You can then make these payments online or by mail using Form 1040-ES.

When to Pay Advance Tax

Advance tax payments are due quarterly throughout the year. The due dates for estimated tax payments are as follows:

1. April 15: for income earned from January 1 to March 31

2. June 15: for income earned from April 1 to May 31

3. September 15: for income earned from June 1 to August 31

4. January 15 of the following year: for income earned from September 1 to December 31

It’s important to note that if you don’t make estimated tax payments or don’t pay enough in estimated taxes, you may be subject to penalties and interest.

In conclusion, advance tax, or estimated tax, is a system used by the United States government to collect income tax throughout the year. If you’re self-employed, receive income from sources that aren’t subject to withholding, or don’t have enough taxes withheld from your regular paycheck, you may need to make estimated tax payments. By understanding how to calculate and pay estimated tax, you can ensure that you’re meeting your tax obligations throughout the year.

-

Sale!

ITR FORM 3/4/5 – SOLE PROP. BUSINESS/ FIRM /LLP(NON AUDIT)

Select options This product has multiple variants. The options may be chosen on the product page -

Sale!

A2X INTEGRATION AMAZON/Shopify -QUICKBOOKS/XERO/OTHER

Select options This product has multiple variants. The options may be chosen on the product page -

Sale!

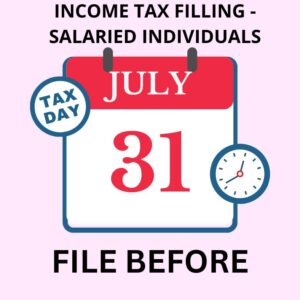

Income Tax Filling – Salaried Individuals

Select options This product has multiple variants. The options may be chosen on the product page -

Sale!

Monthly Bookkeeping – Canada

Select options This product has multiple variants. The options may be chosen on the product page